SARS calculates your income tax liability on the “sliding scale” basis. In other words, the amount of tax due to SARS increases as your taxable income increases.

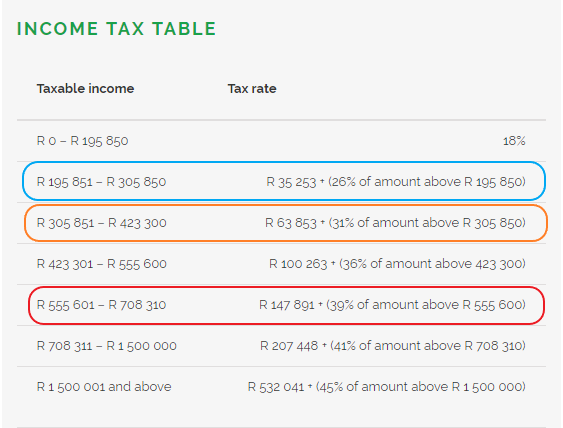

There are seven income brackets (tax tables), and your SARS tax liability is calculated based on where your total taxable income falls within these brackets.

If you earn income from more than one source, at the end of the financial year, the total taxable income from all sources are added together. SARS will then calculate your tax liability based on the total.

In most cases, this will result in you paying less tax than the amount due to SARS. This tax shortfall will exist because each employer would have been calculating your monthly PAYE* due to SARS at lower points on the “sliding scale”.

*PAYE represents income tax that is paid to SARS by your employer monthly.

Illustrative example 1**:

Taxpayer Bob works at Employer A and Employer B

He earns R250 000 during the year from Employer A and R350 000 during the year from Employer B.

The PAYE deducted from his salary from Employer A would have been R49 332. The PAYE deducted from his salary from Employer B would have been R77 540. Therefore, the total amount of income tax that Bob paid to SARS during the year would have been R126 872.

However, when Bob files his tax return with SARS, his total taxable income will be R600 000 . The income tax due on this amount of income is R165 207.

Therefore, Bob will have an amount of R38 335 due to SARS.

Illustrative example 2**:

Taxpayer Bob works at Employer A and has his own business where he earns additional income as a sole proprietor.

He earns R250 000 during the year from Employer A and R350 000 during the year from his own business.

As per the tax table above, the tax deducted from his salary from Employer A would have been R49 332. However, he does not pay monthly PAYE on the business income he earns privately. Therefore, the total amount of income tax that Bob paid to SARS during the year would have only been R49 332.

However, when Bob files his tax return with SARS, his total taxable income will be R600 000. The income tax due on this amount of income is R165 207. Therefore, Bob will have an amount of R115 875 due to SARS.

**Note that the above examples do not take any taxable deductions into account (for example, tax rebates, medical aid contributions, retirement annuity fund contributions, amongst others).

The purpose of the examples above is to show that SARS taxes income earned from multiple revenue streams in totality at the end of the financial year. These revenue streams are taxed separately during the tax year, and this can, therefore, lead to an under-provision of tax can occur at the end of the tax year.

If you do earn income from an employer who deducts PAYE from your monthly salary, please send us your payslip/s every month so that we can take that into account when we calculate the provisional tax due to SARS.